Determining the right price for a used car can feel like navigating a maze. Whether you’re a buyer aiming for a fair deal or a seller wanting to maximize your return, understanding the market value is crucial. Fortunately, a variety of tools are available to help you accurately price used cars. This guide will explore the best tools and strategies for pricing used vehicles in 2024, ensuring you make informed decisions.

Why Accurate Used Car Pricing Matters

Accurate pricing is the bedrock of a successful used car transaction. For buyers, knowing the right price prevents overpaying and ensures you’re getting a fair deal. Overpaying can lead to financial strain and buyer’s remorse, especially considering the depreciation factor of vehicles. Conversely, for sellers, accurate pricing is vital to attract buyers and sell your car quickly and at the best possible price. Underpricing can mean losing out on potential profit, while overpricing can deter buyers, leading to a prolonged selling process and potentially a lower final sale price.

Using the right Tools For Pricing Used Cars empowers both parties with the knowledge needed for confident negotiations and transactions. These tools provide data-driven insights, moving beyond guesswork and subjective opinions.

Types of Tools for Pricing Used Cars

The landscape of used car pricing tools is diverse, offering various approaches to valuation. Here’s a breakdown of the most effective types:

Online Valuation Tools

Online valuation tools are the most accessible and widely used resources for pricing used cars. Websites like Edmunds, Kelley Blue Book (KBB), and NADA Guides offer platforms where you can input vehicle details and receive estimated values.

-

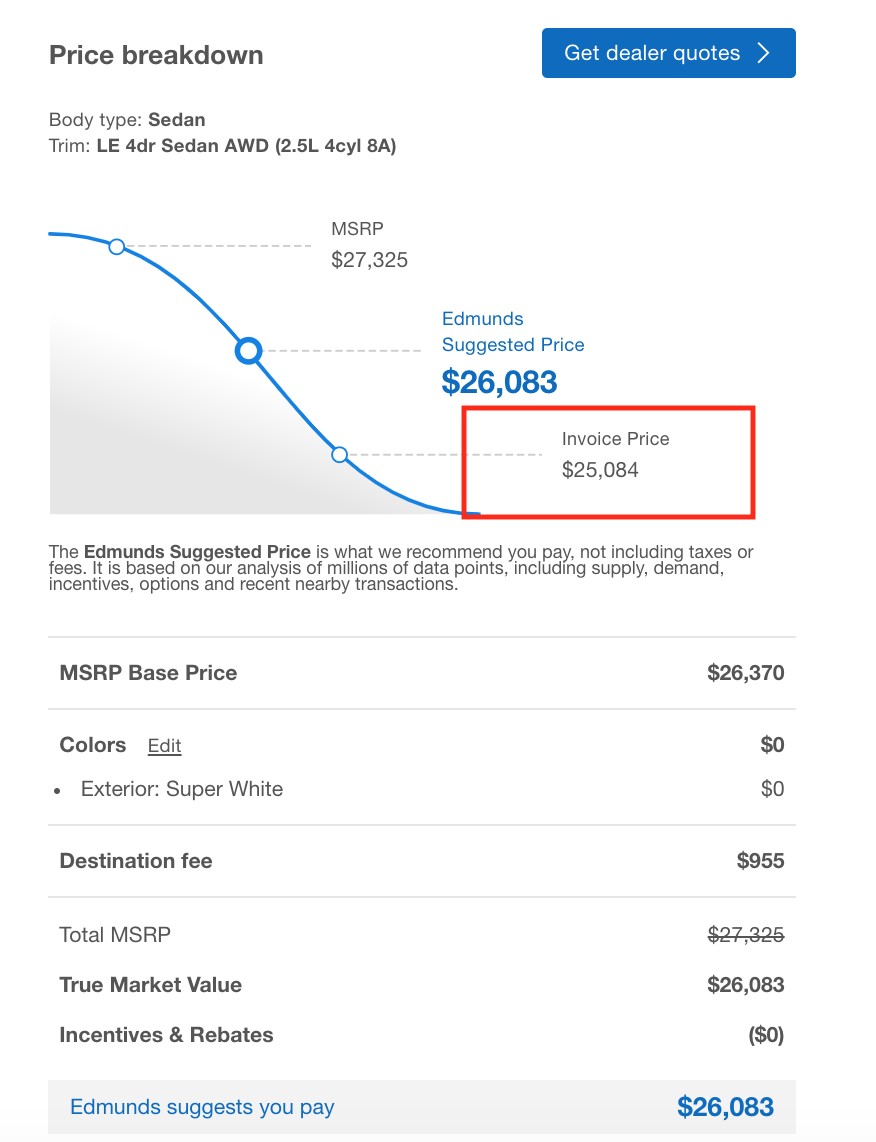

Edmunds True Market Value (TMV): As explored in the original article, Edmunds TMV, or Edmunds Suggested Price, analyzes millions of data points, including recent transaction data, supply, demand, and incentives, to estimate the average price others are paying for similar vehicles in your area. This tool provides a realistic benchmark for negotiations.

Edmunds invoice pricing example

Edmunds invoice pricing example -

Kelley Blue Book (KBB): KBB is another industry standard, providing a range of values including trade-in value, private party value, and dealer retail value. KBB’s reputation and extensive data history make it a trusted source for both consumers and professionals.

-

NADA Guides: NADA (National Automobile Dealers Association) Guides also offer comprehensive used car valuations. Similar to KBB, NADA provides different value types to cater to various transaction scenarios.

These online tools are invaluable as starting points in your pricing research, giving you a solid foundation before further investigation.

Dealer Appraisals

While online tools offer estimations, a professional dealer appraisal provides a real-world assessment of your vehicle’s value. Dealers have access to current market data and can physically inspect your car to factor in its specific condition, features, and local market demand.

Getting appraisals from multiple dealerships can give you a range of trade-in offers and a better understanding of what dealers are willing to pay. However, remember that dealer appraisals are often on the lower end, as they need to factor in profit margins and reconditioning costs before reselling the vehicle.

Private Party Valuations

For sellers considering a private sale, understanding the private party value is essential. Tools like KBB and Edmunds provide private party value estimates, reflecting the price you might expect to receive when selling directly to another individual.

Private party values are typically higher than trade-in values because there’s no dealer intermediary taking a profit. However, private sales also involve more effort and responsibility in terms of marketing, negotiation, and paperwork.

Market Analysis Tools

Beyond individual vehicle valuation, understanding broader market trends can refine your pricing strategy. Market analysis tools provide insights into used car market conditions, including price fluctuations, demand shifts, and inventory levels.

Websites that track automotive industry data and market reports can offer valuable context. For example, knowing if used car prices are generally rising or falling in your region can influence your pricing decisions and negotiation approach.

Key Features to Look for in Used Car Pricing Tools

When selecting tools for pricing used cars, consider these key features to ensure accuracy and effectiveness:

-

Data Sources and Accuracy: The reliability of a pricing tool hinges on its data sources. Tools that utilize real-time transaction data from dealerships and auctions, like Edmunds TMV, tend to be more accurate than those relying on outdated or limited data. Look for tools that clearly state their data sources and update frequency.

-

User-Friendliness: A user-friendly interface is crucial for efficient and stress-free pricing. The tool should be easy to navigate, allowing you to input vehicle information quickly and understand the results clearly.

-

Customization Options: Accurate pricing requires considering specific vehicle details. The best tools allow you to customize your valuation by inputting:

- Vehicle Identification Number (VIN): VIN ensures accurate model and trim identification.

- Mileage: Mileage is a significant factor in used car value.

- Options and Features: Optional equipment and features impact a car’s desirability and price.

- Condition: Accurately assessing your car’s condition (excellent, good, fair, poor) is critical. Be honest about wear and tear.

-

Market Trend Analysis: Some advanced tools offer insights into market trends, helping you understand if prices for your vehicle type are rising or falling in your area. This feature can be particularly useful for sellers aiming to time the market effectively.

Step-by-Step Guide to Pricing Your Used Car with Tools

Here’s a practical guide to pricing your used car using the tools discussed:

-

Gather Vehicle Information: Collect your car’s VIN, current mileage, and a detailed list of its options and features. Note any aftermarket accessories, although these may not significantly increase value and could even decrease it in some cases, as mentioned in the original article regarding aftermarket parts and TMV.

-

Utilize Online Valuation Tools: Start with at least two or three online valuation tools (Edmunds, KBB, NADA). Input your vehicle information accurately into each tool and record the estimated values. Pay attention to the different value types (trade-in, private party, dealer retail).

-

Seek Dealer Appraisals (Optional but Recommended): If selling or trading in, get appraisals from a few local dealerships. This provides real-world offers and insights into dealer perspectives.

-

Consider Local Market Conditions: Research local used car listings for similar vehicles to see how your online estimates compare to actual asking prices in your area. Local demand and supply can influence prices.

-

Set a Realistic Price Range: Based on your research, establish a realistic price range. For sellers, consider starting slightly above your target price to allow for negotiation. For buyers, use the tools to determine a fair offer within the estimated range.

Tips for Getting the Most Accurate Used Car Price

-

Be Honest About Condition: Accurately assess your car’s condition when using online tools or describing it to potential buyers. Overestimating condition leads to inaccurate valuations and potential negotiation setbacks.

-

Research Market Trends Regularly: Used car markets can fluctuate. Monitor pricing trends for your vehicle type in your area to stay informed and adjust your pricing strategy as needed.

-

Consider a Professional Appraisal: For high-value vehicles or if you need a precise valuation for legal or insurance purposes, consider a professional appraisal from a certified appraiser.

Conclusion

Pricing a used car effectively requires leveraging the right tools for pricing used cars and understanding market dynamics. Online valuation tools like Edmunds TMV, Kelley Blue Book, and NADA Guides provide excellent starting points, while dealer appraisals and market analysis offer further refinement. By combining these resources and following a systematic approach, both buyers and sellers can confidently navigate the used car market and achieve fair, informed transactions. Remember to always prioritize accurate vehicle information and consider local market conditions for the most precise pricing outcomes.